Market Neutral funds are one of the more seductive sounding products offered by the Asset Management sector; who would not be tempted by this?

The investment objective is to achieve a positive return over a 12 month period in all market conditions.

The thought of smooth, steady progress while markets zig zag around hysterically suffering periods of euphoria followed by heart attacks is tempting indeed, but how do they propose to do it? Investopedia:

A strategy undertaken by an investor or an investment manager that seeks to profit from both increasing and decreasing prices in a single or numerous markets. Market-neutral strategies are often attained by taking matching long and short positions in different stocks to increase the return from making good stock selections and decreasing the return from broad market movements. Market neutral strategists may also use other tools such as merger arbitrage, shorting sectors, and so on. There is no single accepted method of employing a market-neutral strategy.

So it isn’t simple, but I think the most common technique is to use pairs trades. The theory here is to pair a short trade, which enables you to profit from a falling price, with a long trade, which obviously profits from a rising price, in the same sector–for example, you might short EasyJet and go long Aer Lingus, or short GlaxoSmithKline while going long AstraZeneca. This should neutralise the effect of a general market movement and shine the spotlight entirely on your stock selections.

While I am open to persuasion, instinctively, this entire strategy worries me on two fronts:

- You are neutralising your greatest ally in investment, namely, the fact that the market tends to drift upwards over time. Due to the effects of slowly growing economies and inflation this is always the likeliest long-term outcome, and so by selling short 50% of the time you are putting half your money in a losing game. You do not want to go to great lengths to eliminate the market when it is rising at 7 or 8% a year.

- After you succeed in neutralising the market, you are left entirely hostage to the performance of your fund manager. Academic research has shown countless times how, after the effects of fees, fund managers struggle to outperform the market. Asking a manager to identify shorts as well as longs is hamstringing them even more than usual. And then, while your fund manager is scuffling around trying to grub a few of basis points here or there by means of a complicated pairs strategy, along comes the annual management fee to take out a meaty 1 or 2% bite.

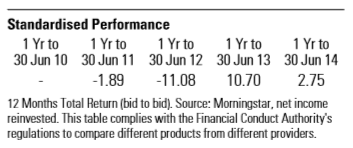

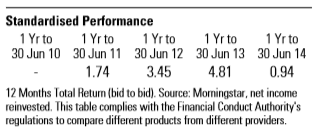

What would you expect the result of a typical market neutral strategy to be, given these objections? I would expect less volatility than the market as a whole, but I would also expect the effects of the fees and the bad short choices to cut most of the gains that would accrue naturally to the longs. Here are the results from the sole two funds that sit in my broker’s Alt – Equity – Market Neutral category:

Fund One:

Fund Two:

At least the second fund is keeping its nose ahead of inflation.

If you are happy with low but positive returns, then what is wrong with cash on deposit or short-term government bonds? If you want something with a low correlation to your equities or equity-based funds, then there is always gold which should be random and volatile enough for anyone. Market neutral funds, from what I can see, look best left to people who want to pay high fees for low and unpredictable returns.

Disclosure: I do not hold positions in any market neutral funds.

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.